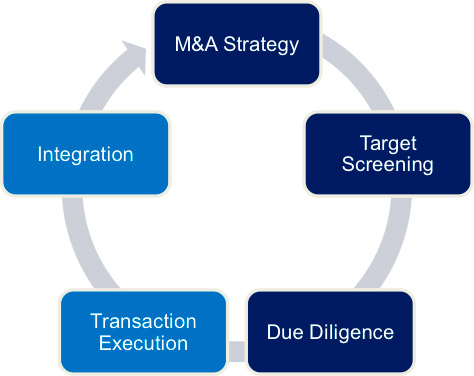

It is no secret that a majority of mergers and acquisitions (M&A) fail to deliver the promised synergies or expected value. For some companies, the problem lies in a flawed strategy for buying the target company. For others, the problems occur after the close as it becomes clear that insufficient rigor was paid to merger integration. It does not have to be this way. Strategic assessments of companies, industry expertise, due diligence, merger integration, and operational improvements represent areas where knowledge and skills are readily available. We are able to guide M&A transactions in multiple sizes, industries, and geographic regions.

It is no secret that a majority of mergers and acquisitions (M&A) fail to deliver the promised synergies or expected value. For some companies, the problem lies in a flawed strategy for buying the target company. For others, the problems occur after the close as it becomes clear that insufficient rigor was paid to merger integration. It does not have to be this way. Strategic assessments of companies, industry expertise, due diligence, merger integration, and operational improvements represent areas where knowledge and skills are readily available. We are able to guide M&A transactions in multiple sizes, industries, and geographic regions.

-

Internal capabilities

-

Strategic goals and alignment

-

Selection criteria

-

Target selection

-

Synergies and value creation

We usually begin with an assessment of internal capabilities to see if they are not only available but also up to the task of meeting the company’s larger M&A goals. Most companies have relatively small M&A or business development teams, which means the processes for assessing and integrating a target company are not readily available. Indeed, the less a company performs M&A the less likely the high-risk process of integration is “routinized” or “internalized.” Large acquisitions are especially susceptible to operational and business risks and require the most attention to performing due diligence, integrating the two companies, and capturing synergies; hence, assessing the availability and quality of internal resources is the first step in achieving these goals.

Mergers and acquisitions present attractive opportunities but are also risky. So, before an acquisition, it’s important to evaluate a company’s strategic and financial goals—determining if they can be achieved faster or more easily via organic growth or an acquisition. To inform this decision, we establish a comprehensive baseline of the business by markets served and by line of business relative to market trends. If our evaluation supports an acquisition, we work with the client to assess which markets will meet the desired objectives and to identify acquisition targets. We leverage experts from our global industry practices to provide an intelligent and thorough market analysis that leads to a clear understanding of industry dynamics, players, and trends. In each M&A transaction, we bring forward recognized experts who provide valuable insights to inform the “Buy or No-buy” recommendation.

Financial criterion alone is a “40,000 feet” view that is not sufficient for evaluating an acquisition. An evaluation of post-acquisition market share, complementary product and service portfolios, cost reduction and synergy opportunities, business unit turnaround needs, and cultural fit are critical elements that help zero in on the right market segments and target candidates. Most important, we always maintain a degree of flexibility from deal to deal, since criteria in one industry may not apply in another.

The target selection process needs to be done rapidly and the criteria explicit and transparent. If the criteria are consistent with the strategic objectives established up front, the right candidates emerge easily and quickly. Analytical rigor is combined with industry insights. For most selection processes, industry knowledge is more valuable than any quantitative metric. An attractive ROI on paper can mean little if the target will require significant turnaround efforts that will stretch internal resources or pose a threat to the cultural identity of the combined organization.

Accurately estimating the financial and strategic value that can be extracted from an acquisition is typically the most critical factor in justifying an investment. Analysts and private investors will evaluate the success of the acquisition based on the ability to capture synergies in the first two years after the close. This requirement for early improvements requires a much deeper level of analysis than a high level financial evaluation; it requires the development of strategic, as well as operational and functional improvement plans that can be implemented quickly to sustain the valuation of the merged entity.

China has been a net capital exporter for three years in a row. Analysis of M&A deal activity shows that the transaction value of outbound deals has been rising by 22% annually since 2009, reaching $79 billion in 2014. Today’s deals cover an expanding number of industries in all regions. Although private enterprises represent a growing share of outbound activity, the largest deals still involve state-owned enterprises. In the past, outbound deals were made primarily with the purpose of obtaining natural resources or raw materials. Today, they’re just as likely to be aimed at helping companies train and develop staff, or giving companies access to overseas revenues and profit pools they’ve not yet addressed.

China has been a net capital exporter for three years in a row. Analysis of M&A deal activity shows that the transaction value of outbound deals has been rising by 22% annually since 2009, reaching $79 billion in 2014. Today’s deals cover an expanding number of industries in all regions. Although private enterprises represent a growing share of outbound activity, the largest deals still involve state-owned enterprises. In the past, outbound deals were made primarily with the purpose of obtaining natural resources or raw materials. Today, they’re just as likely to be aimed at helping companies train and develop staff, or giving companies access to overseas revenues and profit pools they’ve not yet addressed.